Travel Insurance for Iran Ultimate Guide

Welcome to the ultimate guide on travel insurance for Iran! Whether you’re planning to explore the bustling streets of Tehran, hike in the picturesque landscapes of the Alborz Mountains, or immerse yourself in the rich history of Persepolis, it’s vital to protect your adventure with the right travel insurance.

When it comes to traveling to Iran, having comprehensive travel insurance is essential. Not only does it provide financial protection in case of unexpected events like trip cancellations or medical emergencies, but it also ensures you have a worry-free journey.

In this article, we will walk you through everything you need about travel insurance for Iran. From understanding the coverage options available to finding the right policy that suits your needs, we’ve got you covered. We’ll also provide insights into specific considerations for obtaining travel insurance for Iran, such as visa requirements and any potential restrictions.

So, whether you’re a seasoned traveler or embarking on your first adventure to Iran, let’s dive into the world of travel insurance and ensure you have a safe and memorable trip.

Why travel insurance is important for Iran

When it comes to traveling to Iran, having comprehensive travel insurance is essential. Not only does it provide financial protection in case of unexpected events like trip cancellations or medical emergencies, but it also ensures you have a worry-free journey.

Iran uniquely blends ancient history, vibrant culture, and breathtaking landscapes. While it offers incredible experiences, it’s essential to acknowledge that travel, like anywhere else, comes with its share of risks. From unforeseen medical emergencies to lost luggage or flight cancellations, having travel insurance ensures that you are prepared for any unforeseen circumstances that may arise during your trip.

Types of travel insurance coverage for Iran

When choosing travel insurance for Iran, it’s crucial to understand the types of coverage available. Here are some common types of coverage to consider:

- Trip cancellation/interruption: This coverage protects you financially if you need to cancel or cut short your trip due to unforeseen circumstances such as illness, injury, or a family emergency.

- Medical expenses: This coverage ensures that you are protected in case of any medical emergencies or accidents during your trip. It includes coverage for hospital stays, medication, and emergency medical evacuation if necessary.

- Lost or delayed baggage: This coverage provides compensation for lost, stolen, or delayed baggage, ensuring that you can replace essential items if needed.

- Emergency evacuation: In the event of a natural disaster or political unrest, this coverage ensures you can safely evacuate from the country.

- Personal liability: This coverage protects you in case you accidentally cause damage to someone else’s property or injure another person.

It’s important to carefully review the coverage offered by different insurance providers and choose a policy that fits your specific needs and preferences.

https://toursofiran.com/blog/iran-travel-risk-map-2023/

Choosing the right travel insurance provider

Several factors must be considered when choosing a travel insurance provider for your trip to Iran. Here are some key considerations:

- Coverage for Iran: Not all travel insurance providers offer a range for Iran, so choosing a provider that explicitly includes Iran in their coverage area is important.

- Reputation and financial stability: Look for insurance providers with a good reputation and financial stability to ensure they can fulfill their obligations in case of a claim.

- Customer reviews: Read reviews and testimonials from other travelers to understand their experiences with different insurance providers.

- Price and coverage: Compare the prices and options different providers offer to find the best balance between affordability and comprehensive coverage.

Considering these factors, you can choose a travel insurance provider that offers the right coverage and peace of mind for your trip to Iran.

Factors to consider when purchasing travel insurance for Iran

When purchasing travel insurance for Iran, there are a few additional factors to consider due to the country’s specific requirements and regulations. Here are some things to keep in mind:

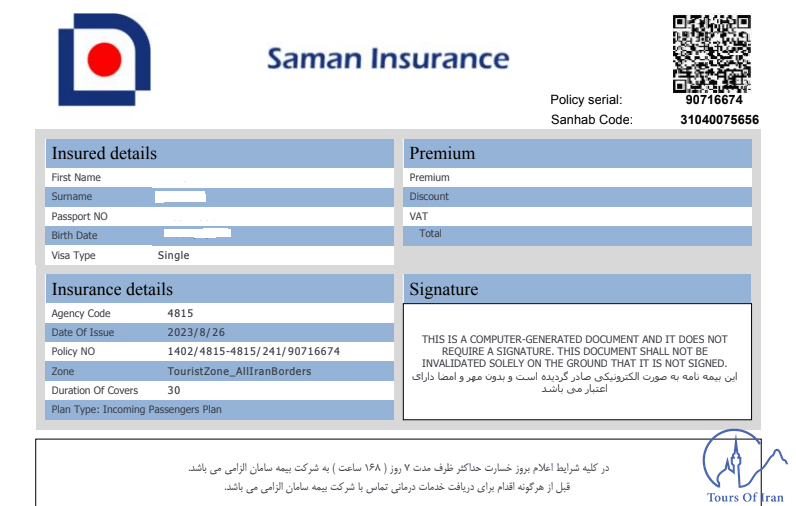

- Visa requirements: Before purchasing travel insurance, understand Iran’s visa requirements. Some visas may require proof of travel insurance coverage, so it’s important to choose a policy that meets the specific requirements of your visa.

- Coverage limits: Check the coverage limits of the travel insurance policy, especially for medical expenses and emergency evacuation. Make sure they are sufficient to cover potential costs in Iran.

- Exclusions and restrictions: Carefully read the policy’s fine print to understand applicable exclusions or limitations. For example, some policies may limit coverage for certain activities or regions within Iran.

Understanding these factors will help you make an informed decision and ensure you have the right coverage for your trip to Iran.

Understanding the fine print of travel insurance policies

Before purchasing any travel insurance policy, reading and understanding the fine print is crucial. The policy’s terms and conditions outline the insurance coverage, exclusions, and limitations. Here are some key points to look for:

- Coverage exclusions: Pay close attention to the exclusions listed in the policy. These are specific situations or circumstances where the insurance will not provide coverage. Familiarize yourself with these exclusions to avoid any surprises.

- Pre-existing conditions: Some travel insurance policies may have restrictions or limitations related to pre-existing medical conditions. Make sure you understand how your specific situation is covered, if at all.

- Claim process: Take note of the procedures and documentation required to make a claim. Familiarize yourself with the claim process to ensure you can easily navigate it.

- Cancellation policy: Understand the cancellation policy, including any penalties or fees that may apply if you need to cancel your trip or change your coverage.

You can avoid misunderstandings or surprises regarding your travel insurance coverage by carefully reviewing and understanding the fine print.

How to make a travel insurance claim in Iran

If you need to make a travel insurance claim in Iran, following the proper procedures is important to ensure a smooth and efficient process. Here are the general steps to take when making a travel insurance claim:

- Contact your insurance provider: Notify your insurance provider immediately after the incident. They will guide what steps to take next and the documentation required.

- Gather necessary documentation: Collect all relevant documentation, such as medical records, police reports, receipts, and other evidence to support your claim.

- Submit your claim: Fill out the necessary claim forms provided by your insurance provider and submit them along with the supporting documentation.

- Follow up: Contact your insurance provider to ensure your claim is being processed and address any additional questions or requirements.

Remember to keep copies of all documents and correspondence related to your claim for your records. By following these steps, you can navigate the claims process smoothly and increase your chances of a successful claim.

Tips for maximizing your travel insurance coverage in Iran

To make the most of your travel insurance coverage in Iran, consider the following tips:

- Read the policy thoroughly: Familiarize yourself with your travel insurance policy details to understand what is covered and any limitations or exclusions.

- Keep contact information handy: Save your insurance provider’s contact information, including emergency helpline numbers, in your phone or on paper if you need to reach them quickly.

- Carry necessary documentation: Carry a copy of your travel insurance policy and any other relevant documents while traveling in Iran.

Additional resources for travel insurance in Iran

If you’re looking for additional resources to help you find the right travel insurance for your trip to Iran, here are some helpful links:

- U.S. Department of State: The U.S. Department of State’s official website provides information on travel advisories and safety tips for Iran.

- Travel Insurance Review: A website that reviews and compares travel insurance providers, helping you find the best option.

By utilizing these resources, you can make an informed decision and find the best travel insurance coverage for your adventure in Iran.

Conclusion

Travel insurance is an essential aspect of any trip. By understanding the importance of travel insurance, the risks and dangers associated with traveling to Iran, the types of coverage available, and how to choose the right provider, you can ensure a safe and memorable adventure.

Remember to carefully review the policy’s terms and conditions, understand the claim process, and stay informed about the latest developments in Iran. With the right travel insurance coverage, you can explore the wonders of Iran with peace of mind, knowing that you are protected every step of the way. So, pack your bags, secure your travel insurance, and prepare for an unforgettable journey through the heart of Persia!

https://toursofiran.com/blog/ultimate-iran-travel-guide-2023/